We introduced the HawaiiKidsCAN Afford College campaign back in May and we’ve enjoyed connecting with community members – including students, educators, and financial services professionals – in the following months. This is designed to be a holistic approach to addressing college affordability, and there are many ways to be involved.

For example, students can still register for our free EVERFI financial literacy and college affordability courses from the campaign’s website. Here is an excerpt from a testimonial from a public school student in a rural community:

“EVERFI is a website that has different activities and games that could help me as an individual person in the future when I become an adult. In EVERFI, I have taken this class called Financial Literacy and it is teaching me about the different types of banks I could put my money into like stocks or normal bank. It is also teaching me how to sign up to make a bank account. The good thing about EVERFI is that it makes learning their content easier than other websites. It keeps it easy and simple to learn complicated things especially like Financial Literacy in a way a high school student can understand.”

Local student perspectives

The HawaiiKidsCAN Afford College campaign is fueled by the perspective of local students and the challenges and opportunities they see when they think about their futures. You can view short clips in our campaign website, as we’ll be rolling these out as social media advertisements to grow student and family awareness about the FAFSA.

While we have hours of student testimonials, here are some favorites:

Kelton

Kelton, a high school football player, plans to continue playing in college while studying kinesiology. When asked if he thought college is worth the money, he said, “Yes, I think college is worth the money…you can get a better education and get a better job in society.” Further, he shared that even if he plays football all the way to the NFL, he still plans to pursue a career in kinesiology “because it would be the closest thing to football” and provide a lifelong connection to the sport and work he loves. When Kelton was exploring his financial options for college, he said, “It was kind of confusing to me in the beginning, but then my counselors and teachers helped me out and made it easier. And then when I got accepted to the schools, I felt like really excited and happy that… some colleges would give me a chance.”

Mila

High school senior Mila shared that she is going to join the Army National Guard after graduation in order to pay for her future attendance at Oregon State University. Her older sister was the first person in their family to graduate from college, and Mila said seeing her sister succeed in college made her “feel like it was possible.” “When I saw that she got scholarships and she had help from my parents and loans, then I was like, I could actually do this.” When asked about college affordability as a barrier for students, Mila shared, “I think that if it was a lot cheaper and was free, then mostly everybody would have gone to college if given the opportunity…the first things that popped into my head when I think of college is jobs. A lot more studying, and just opportunity.” For Mila, “going into the Army was definitely the financial aid paying for my college because, like I said, my older sister didn’t. She had scholarships, but it was still hard for us to support her. So anything that could help me get [through] college would be really helpful. And I thought that the Army, the Army National Guard, was really a good choice for me.” When asked whether she had completed the FAFSA application, she said, “I tried applying for it, but my parents don’t really understand it. And my older sister is always busy, so nobody could really help me out with it. And so I kind of just gave up trying to fill it out.” Students like Mila are prime examples of the young people we hope to open opportunities to by breaking financial literacy barriers to completing the FAFSA application for families.

Lorenzo and Nisha

In a group taping with siblings Lorenzo, a senior Kamaile Academy football player, and Nisha, a Kamaile Academy alumna and current college student, Nisha shared their positive experience attending college and how financial aid was helping to make it possible for them to get the full college experience and pursue their career goals. When told about how much financial aid is left on the table (an estimated $3.75 billion in Pell Grants nationally and more than $12 million in Hawaii) when only half of graduating seniors complete the FAFSA, Lorenzo said “I don’t really see as [many] kids my age or our age in general go to college because they feel like they can’t support themselves financially. But that much money is just ridiculous to have left over…I know a lot of kids in my neighborhood who could use that money to get where they want to be.”

Focus group opportunities

Students, parents, and educators – share your perspective and get financial compensation for your time by joining a virtual or in-person focus group this year. This feedback directly shapes our policy and programmatic strategies to move the needle for kids, so we’re grateful for your participation.

Calling financial services professionals and community partners

Our work aims to galvanize our broader community to help students realize their higher education dreams. This includes folks with experience in the financial services sector and CPAs who can help families understand complex terms and gather the correct documents. We’ve already co-hosted a CPA pau hana in August in partnership with Hualalai Financial to engage a coalition of professionals from companies including Northwestern Mutual, Bank of Hawaii, WestPac Wealth Partners, Chamber of Commerce Hawaii, and Edward Jones.

If you are interested in joining our coalition and helping families navigate the FAFSA, please complete this short form to let us know how you want to be involved.

This approach was inspired by the successful Harvard H&R Block FAFSA Experiment.

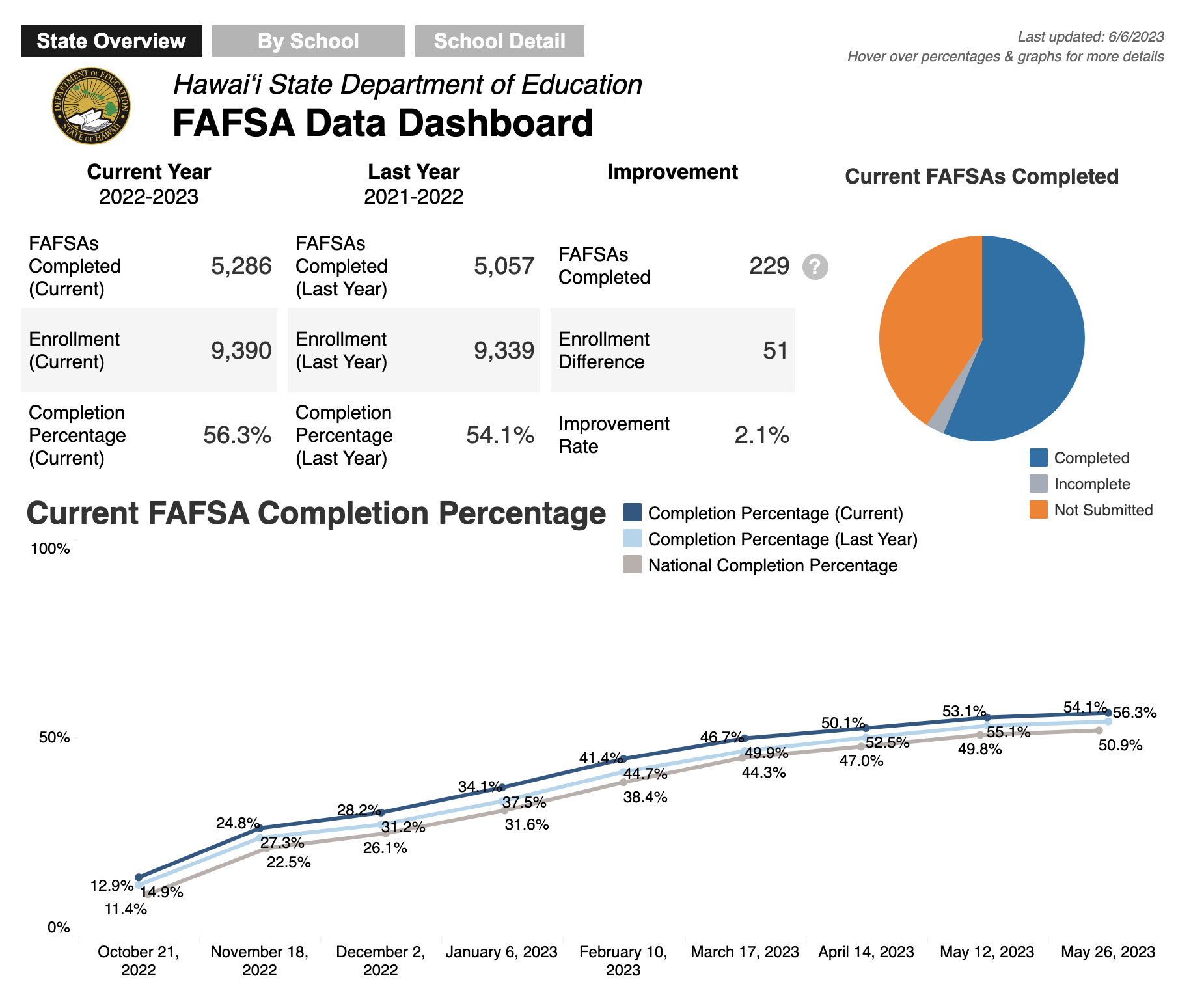

FAFSA completion data

Why are we doing this work? We know that many students will never even know the financial aid options they could have received for higher education support. This includes countless local students who could be going to a University of Hawaii community college for free via the Hawai’i Promise Program.

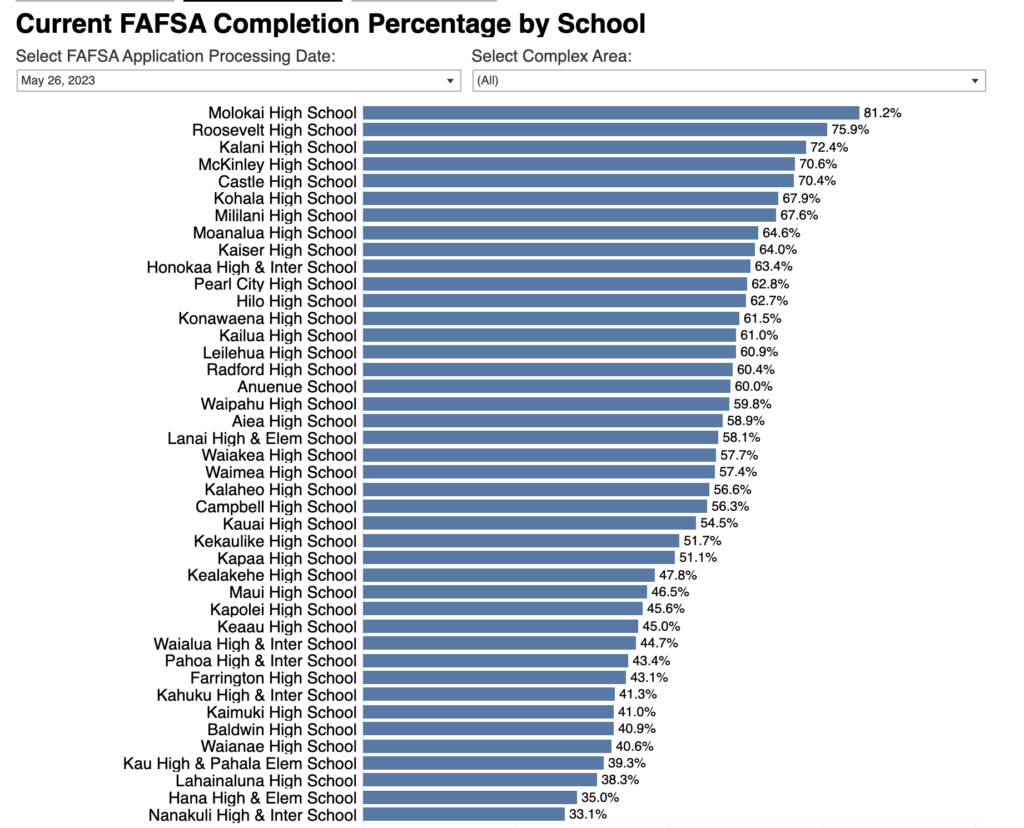

Data can be the best storyteller, yet many people have never seen the official Hawaii DOE FAFSA Data Dashboard. Since we started looking at this data, we’ve never seen Hawaii cross the 60% completion threshold in a year as a state, and you’ll see that many schools are far below 50% completion. Sadly, many of these schools likely have a higher proportion of students who would be eligible for generous aid packages.

Nationally, Hawaii ranks around the middle of the pack, lagging far behind in total percentage and growth compared with states like Louisiana, California, Texas, and Illinois that have implemented bolder universal policies around FAFSA completion.

Relevant readings

With so much happening in this area of policy, we’ll be sharing out the latest research and developments from around the country. Here are a few to get you going:

-

- The 74: After a multi-year evaluation revealed that nearly half of all graduates were not meeting the minimum criteria for entry into the state’s public colleges and universities, Rhode Island aligned its graduation standards to match college-eligibility standards. The state now makes FAFSA a requirement, adds real-world courses, and ends seat time as a credit criteria, thereby reimagining high school graduation standards.

- K-12 Dive: Recent research shows that Generation Z values postsecondary education but is increasingly interested in alternatives to four-year colleges such as community college, career and technical education, and on-the-job training. Additionally, 90% said the government and private sector have the societal responsibility to play pivotal roles in defraying the cost of higher education.

- University of Hawaii: The total outstanding U.S. college-loan balances came in at nearly $1.64 trillion, however, Hawaii ranks 2nd overall in the nation with lowest amount of student debt. The University of Hawaii’s President cites UH’s “superb affordable options for local residents, excellent financial aid, and fantastic range of excellent educational opportunities at every level” for the remarkable success.

- Higher Ed Dive: In an effort to make tuition prices more transparent, colleges across America are decreasing their ticket price to reflect the relative price most students pay after discounts. In a recent study by Sallie Mae, 81% of students said they eliminated colleges based on price before even applying, meaning they had no knowledge of what they would actually pay after discounting and financial aid. For example, Colby-Sawyer College cut its price from $46,364 to $17,500, a drop of more than 60% in an effort to meet their bottomline.

Campaign Partners

Follow us

To help families, schools, and community members more easily engage with our campaign, we’ve launched affordcollegehi.com and social media accounts @affordcollegehi on Facebook, Twitter, and Instagram.